Before the pandemic hit, many companies still used a "wait and see" strategy before deciding to enter the Vietnamese market, however, when the pandemic broke out with the story of the global supply chain, we noted that many companies are coming up with a more specific action plan. The wave of displacement from China is still hot, and Vietnam needs to be prepared to "welcome eagles to nest". They found that investors are still particularly interested in three ways to enter the market:

- Buying land directly from companies operating industrial parks. This is the traditional method of acquiring industrial assets in Vietnam when industrial park operators lease land to various tenants during the lease cycle.

- Establish strategic joint ventures with reputable local partners who have the right to use the land fund and Source Ang Bach Ma (White Horse) Vietnam Ceramic Factory LogisValley Warehouse My Phuoc 4 Industrial Park can support foreign investors in the process of completing procedures and business licenses. A recent example is Boustead Projects' acquisition of a 49% stake in Bac Ninh Industrial Development Joint Stock Company in Yen Phong Industrial Park for about $6.9 million in June 2021.

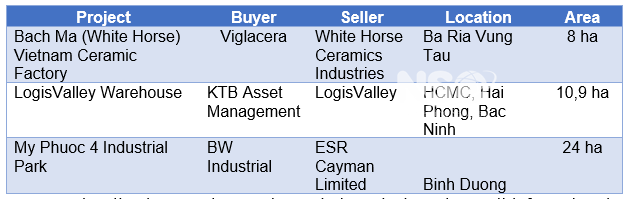

- Either direct land acquisition, or copy and sublease of industrial real estate in operation with stable income. Recently, KTB Asset Management (South Korea) bought three LogisValley logistics centers in Vietnam for $ 105 million and leased them to LogisValley itself.

The real estate M&A market in Vietnam is active, but there are still emerging market challenges that still need to be overcome. Finding a reliable joint venture partner is also not an easy problem because the partner is not only the one who owns the land bank in strategic locations and feasible projects but also has expertise in the local market and has a commitment to long-term cooperation,reliable. Therefore, building trust is more important. The investor depends on preliminary information along with agreements from the supplier, while the supplier depends on the portfolio, financial ability and expertise of the investor. Due to the lack of transparency in the market, listed companies are given priority to both parties as all information about the company such as financial and legal information is made publicly transparent.

The more transparent the market, the more interested foreign investors are. In fact, foreign investors with a lot of capital are waiting to be invested in real estate. Markets are not transparent enough, there is not enough information and data, slow transactions and unclear land ownership – all of these issues are huge challenges for foreign investors.

Some outstanding industrial real estate M&A deals in 2021

Don't hesitate to call us: +84 90 806 93 99

Source: Vietnam Industrial Parks Forum 2022