INTRODUCE ABOUT THE NHON TRACH I INDUSTRIAL PARK - DONG NAI PROVINCE.

1. General introduction:

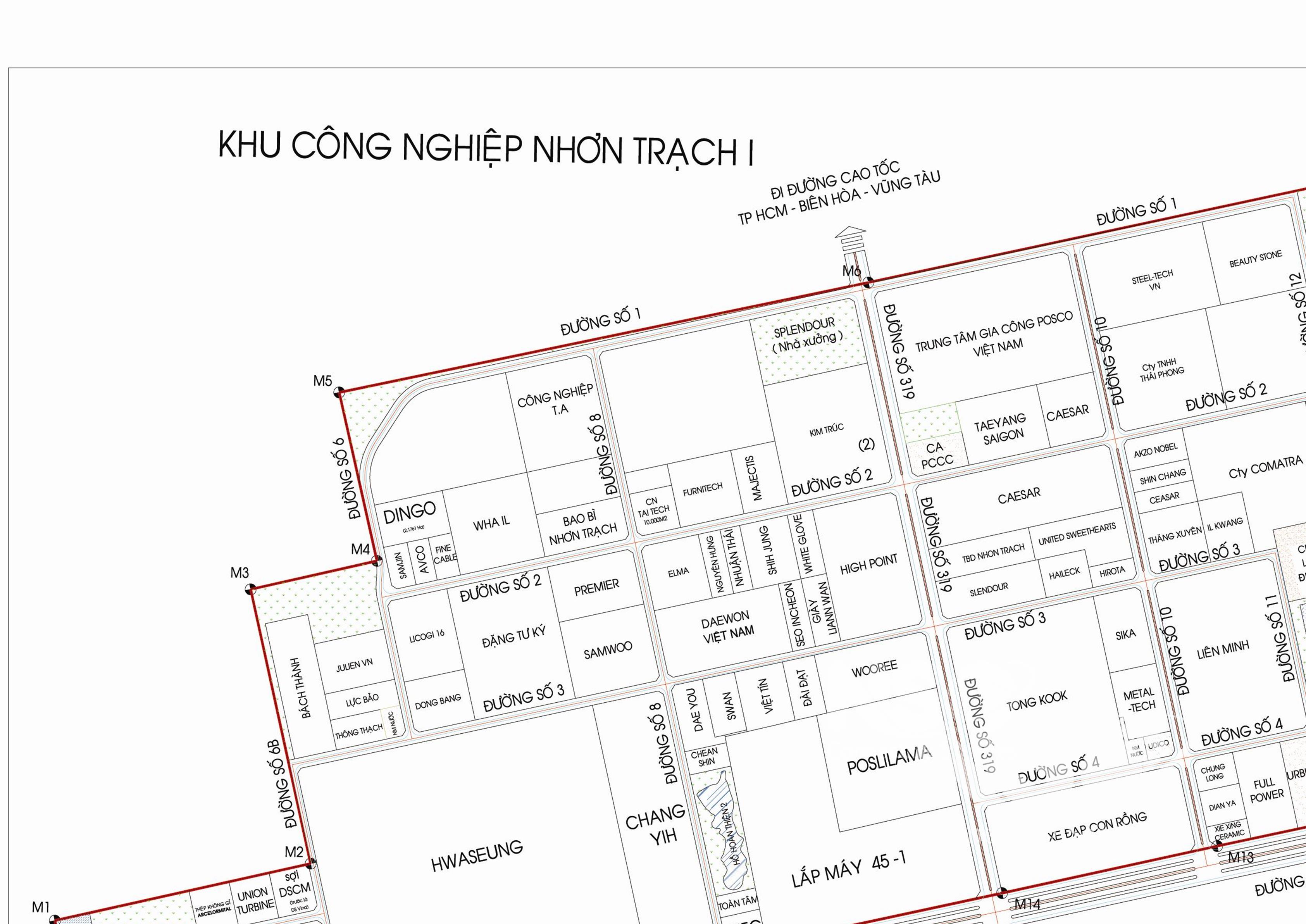

- Name of IP: Nhon Trach I Industrial Park - Dong Nai province.

- Address: located in 3 communes Hiep Phuoc, Phuoc Thien, and Phu Hoi, Nhon Trach district, Dong Nai province.

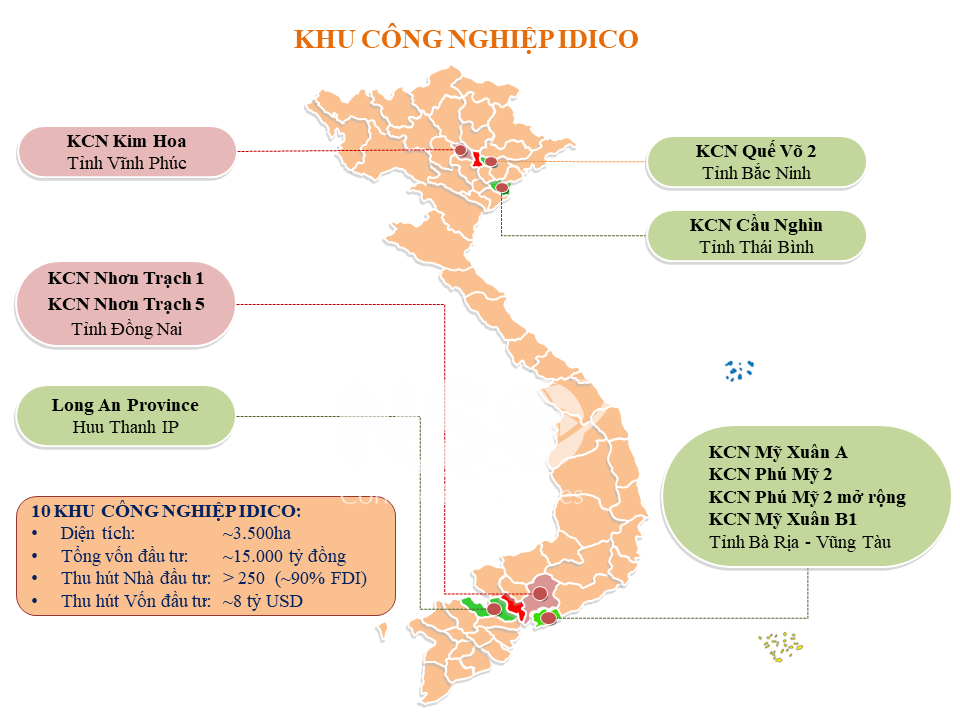

- Investor: IDICO One Member Limited Company and IDICO Industrial Park (IDICO-URBIZ).

- Land tenure: 2048.

- Total land area: 448.5 ha.

- Vacant land area: 100% filled

- Rent: About 180 USD/m2

- Land transferred in Nhon Trach Industrial Park 1: Please contact: 0946 522 847 (Man).

2. Geographical location:

With the advantage of development in the center of the southern key economic region of Dong Nai province and Ho Chi Minh City. Ho Chi Minh. The industrial zone fully enjoys the connectivity advantages of the regional transport hub. The presence of new infrastructure projects in recent years has brought Nhon Trach 1 industrial park more advantages in 3 main modes of transport: by road, aviation, and by sea.

• By road: 50km from Ho Chi Minh CBD, 40km from Bien Hoa City, 60km from Vung Tau City.

• Aviation: 55km from Tan Son Nhat international airport, 15km from Long Thanh international airport.

• By sea: 15km from Go Dau port, 48km from Sai Gon port, 22km from Phu My Port, 60km from Vung Tau port.

Nhon Trach 1 Industrial Park is adjacent to: Nhon Trach 2 Industrial Park, Nhon Trach 3 Industrial Park and only 5 - 10 minutes to connect with Nhon Trach 4 - 5 - 6 Industrial Park, Ong Keo Industrial Park. Besides, it is also easy to connect with key industrial park projects of Long Thanh district such as Amata Long Thanh industrial park, Long Binh industrial park, An Phuoc industrial park, ...

- . Investment attraction fields:

- Some industries that attract investment in enterprises: Manufacturing, processing, manufacturing machinery and equipment, iron and steel; Producing construction materials, manufacturing and repairing motorcycles and equipment; Power electronics; Manufacturing and processing leather shoes and garments; Processing industrial and food products; Other industries do not pollute,...

- With the above key industries, currently Nhon Trach 1 Industrial Park has attracted investors from many countries such as Korea, Taiwan, Switzerland, Malaysia, France, USA,... some typical enterprises: Lien Minh Vina Textile Company (Taiwan), Wooree Vina Bulb Company (Korea), Dragon Bicycle Company (Taiwan), Hwaseung Shoe Company (Korea), Chemical Company Vietnamese Sika (Switzerland)...

4. Infrastructure in the IP:

- .1. Traffic system:

The main axis system has 4 lanes, the internal traffic system has 2 lanes, and the capacity to withstand H30 loads.

- .2. Electricity:

Power supply: The industrial park is supplied with electricity from the Tuy Ha 110/22KV substation, a capacity of 182MVA, managed and operated by IDICO Housing and Urban Development Investment Joint Stock Company (IDICO – UDICO). Tuy Ha 110KV substation is connected and supplies 110KV power from the national power system through Long Binh 220/110KV transformer station with a stable and quality power source.

- .3. Water:

Water supply: The factories in the Industrial Park are supplied with water from the Tuy Ha Underground Water Plant with a capacity of 22,000m3/day and night provided by the Investor IDICO-URBIZ.

- .4. Wastewater treatment:

The centralized wastewater treatment plant is located in Nhon Trach 1 industrial park with a treatment capacity of 6,000m3/day. Currently, IDICO-URBIZ is carrying out investment procedures to renovate and upgrade the wastewater treatment plant to 10,000m3/day.

- .6. Communications:

The communication system provided by network operators such as VNPT, FPT, Viettel... ensures smooth domestic and international communication. Including a full range of services such as: telephone, mobile phone, Fax, Internet...

- . Investment incentives, factory land lease in Nhon Trạch 1 Industrial Park:

Exemption for 2 years and reduction of 50% of the payable tax for the next 4 years for incomes of enterprises from implementing new investment projects in industrial parks (According to Decree 218/2013/ND-CP dated December 26th 2013).